Dear Nieces

This year, for Christmas you have a choice of £100 gift from me. If you would like more you can have it but only if you are prepared to match it and invest it in a stocks and shares ISA. I’ll go up to £600 each, but only if you match it and invest it in a stocks and shares ISA. You can’t spend any of it now.

The current annual limit for an ISA is £20,000 so if you have a Lifetime ISA or a Help to buy ISA you can still save up to £20,000 in total each year in ISAs. The advantages of saving in an ISA is that you do not pay tax on any interest or other gains you make. You can, if you’re rich enough, invest as much as you like outside of an ISA in stocks and shares but you have to pay tax on any profits you make. Let’s not worry about that just yet.

I’m very happy for the next five years to match, up to £600 per year, whatever you’re able to save in a stocks and shares ISA, in addition to whatever you’re saving elsewhere.

You can choose any amount you like – from £10 to the full £600. All you have to do is match it. Over a year, £50/month will reach £600, over a year. If you don’t think you can sustain saving £50 a month then choose a lower figure. It will be easiest to set up a direct debit into a new ISA account than have to think about it each month. This is also the most financially and time efficient way to save. You don’t have to think about it. You can add lump sums to the savings whenever you want to if you get a windfall from anywhere.

Why am I making you this offer? Because I want you to learn about the benefits of seriously saving as early as possible in your life and to benefit from the passage of time to build your savings into a serious pot for the future.

I encourage you to understand about why I think this is a good idea so please read the draft blog I’ve written below. I can help you set up a stocks and shares ISA account when you’ve had a chance to think. If I haven’t heard from you by the end of January 2021, I’ll assume you don’t want to do it and you’ll still get £100 from me, in total. If you want £600 from me read on!

Lots of love and best wishes,

Merry Christmas and a very happy New Year

Uncle Shaun

Money makes money.

Do you believe only rich people can save money and get richer?

Do you know the adage “money makes money”?

It’s easy to imagine rich celebrities or business leaders investing their millions, and getting even richer. Who wouldn’t buy loads of shares or invest in this or that, if they had money to spare?

Do you believe that you too could be part of making money in this way? Well, believe it or not, if you start early enough, and are a little disciplined in your saving (and therefore your spending) then you too can get richer fairly easily. You don’t need a lot of money to start. You can start from as little as £20 per month.

Sadly, nowhere near enough people know this but I want you to know it sooner rather than later. Don’t leave it too late to realise your money can make money too, if only you save it in the right way and start doing it while you’re young.

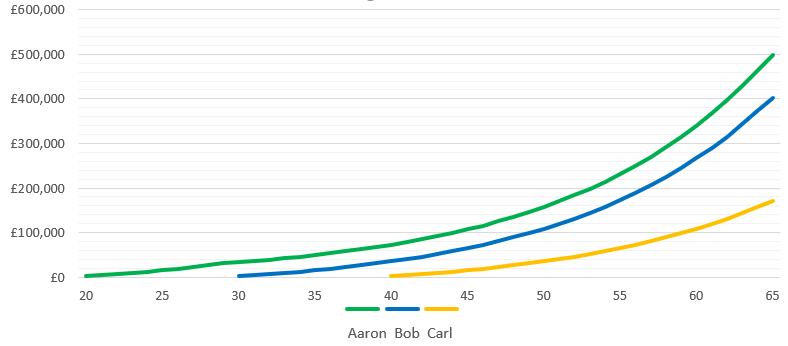

Here’s a story about three people who wanted to save their money for when they were retire at 65 years old. You don’t have to plan that far ahead, but just go with this for now.

Aaron, Bob and Carl all put their savings in to investments that give them an average of 8% growth per year. That’s a good rate of return compared to most bank and savings accounts at present which may give nothing, as little as 0.1% per year, or, if you’re lucky some cash ISAs might give you 1.5%.

Aaron begins saving when he’s young like you, just 20 years old, and he saves £2000 per year for ten years. That means he’s saved in total, £20,000. He leaves that invested in stocks and shares to grow thereafter until he’s 65 years old. He doesn’t add to it or take anything away.

Bob doesn’t start saving until he’s a bit older 30. He has a baby on the way and realises he needs to start saving for his or her future. He too saves £2000 per year and continues doing that for 35 years, until he’s 65. He will have saved £70,000 in all.

Carl starts saving when he’s 40 years old. He’s been busy focusing on his career until now and realises he hasn’t got that much financial security yet as he’s been renting in London and didn’t have much spare cash until he got his most recent promotion. He too saves £2000 per year and he’s able to do that for the next 25 years, until he’s 65. He will have saved £50,000 in total.

Who will have the biggest retirement pot of money when they reach 65?

Well, despite saving the least amount and because he started early, Aaron’s savings grow to almost half a million pounds by the time he’s 60. Half a million! And he only saved £20,000!

It’s a bit sad for Bob and Carl. They’d saved so much more but don’t manage to acquire anything like as much. That is simply because they didn’t start early enough. In fact, if Aaron had carried on saving £2000 each year until he was 65, he would have saved £90,000, that in turn, would be worth £835,000 by the time he was 65! Almost ten times as much!

Impossible you think?

Well I’m really pleased that it’s not impossible, but it will be if you delay starting. You don’t have to save £2000 per year. You must decide what you can afford to save now. Hopefully in time you’ll be able to save more in time.

One problem with this type of saving is that it’s for the long term. It’s not money you should consider that you can access at any time. That’s not to say you can’t if you have to, but because your money will be invested in stocks and shares, and because the value of these go up and down you don’t want to have to take your money out when the market has crashed – like it did at the start of the pandemic. You want to chose when to take it out and do it in a planned way.

Read on, learn what you have to do and I will help you get started.

This is a graph of how Aaron, Bob and Carl’s savings grew, until they were 65. Remember Aaron had an extra £2000 a year to spend himself after he reached 30 years old, and he still accumulated so much more.

Of course you’re wondering where does all the extra come from? How does Aaron’s £20,000 turn into almost half a million pounds (or if he’d carried on saving his £90,000 turn into £835,000)?

It happens because he’s invested it in assets that grow over time. Parents do the same with their children! At the beginning babies are little but as their parents spend on food, water, environmental and emotional warmth their babies grow into adults, with increasing wisdom as they get older and learn more. There are investment products – savings accounts, shares and bonds that also grow over time and reward you, not with their love and kindness but with what’s called compound interest.

Just like children vary in how fast they grow, and how wise they become, – let’s face it we don’t all become professors of rocket science – so too, investments grow at different rates. When we’re talking about money, we usually call the rate of growth the return (on the original investment). Invest £1 for a year and if the return rate, (also called the interest rate) is 50% (per year) you’ll get £1.50 at the end of a year. A year later that £1.50 will have grown further to £2.25 (because £0.75 is 50% of £1.50). Continue this on for a few years and that £1 you started with will have grown enormously.

Unfortunately, growth rates, returns or interest rates of 50% are few and far between but they do happen, and sometimes much better. When the COVID-19 pandemic started the stock market crashed and investors devalued many companies so their share prices dropped. At that time, it was possible to buy shares in Amazon for just £1500 each. Today they’re worth about £2400 each. That is a 60% return in less than a year so you can see such growth is not impossible. But it can’t be relied upon.

In 2000 there was a new company called Oxygen Holdings that people thought would become very valuable in time. Oxygen Holdings shares were just 2p each to buy, when the company ‘floated’ (joined the stock market). However, within 2 hours of joining the stock exchange they had jumped to 65p each. That’s 3150% – in less than one day! They dropped down to 38p each a few days later. If you had bought in then thinking you’d got bargain you were going to be disappointed. Sadly they never went back up and many investors sold when the price slumped. I made a 72% loss when I sold at 11p per share.

These two examples show that the stock market can be a roller coaster, but both examples are over very short periods of time and with only one company at a time.

It is now easy to invest in all the companies in the stock market and whilst the whole market does go up and down every day, over the years, on average over many years it just goes up. That’s because the world population is growing and people want more stuff and they want to do more. They want more technologically advanced lives, they want to travel more, eat better and live better than every generation before them. So as long as we start looking after the planet better there’s no reason why that shouldn’t continue, as it has done for the last one hundred years.

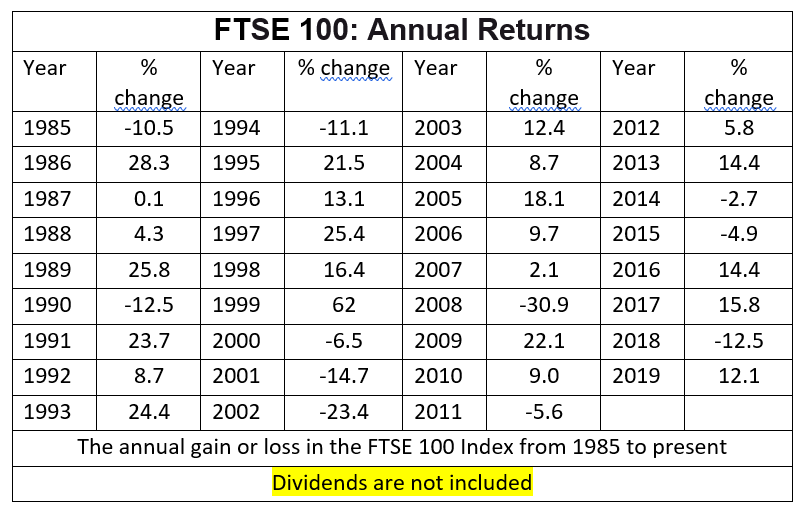

This table shows you how much the UK stock market has gone up and down in the last 25 years

On average from 1985 to 2019 the FTSE 100 (the one hundred biggest publicly owned companies) in the UK grew in basic share value by 5.04%. The FTSE All Share Index (representing all the companies on the UK stock exchange) grew slightly more at 5.49% per year.

A really vital sentence in the table above that is highlighted is this: Dividends are not included.

When dividends are included it is easy to achieve rates or around 8% as Aaron, Bob and Carl enjoyed. I’ll explain dividends in a moment.

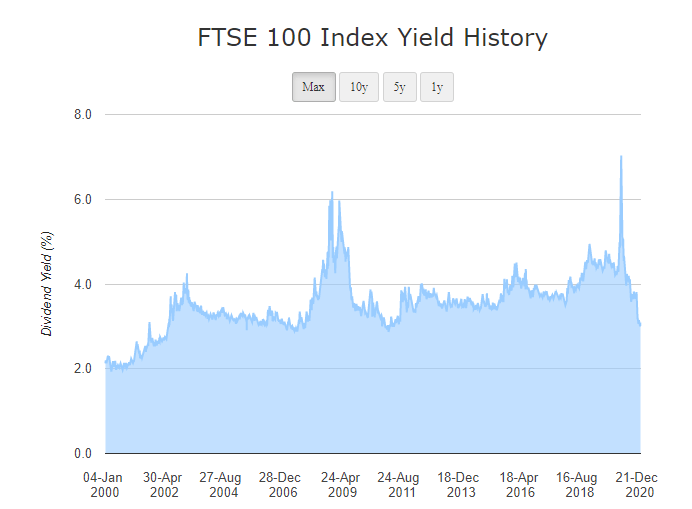

On the next page is a graph of the historical dividend ‘yields’ the FTSE has returned in the last 20 years.

A dividend is a payment to a shareholder for owning part of the company. In 2020 as company profits collapsed with the pandemic the amount companies could pay out to shareholders plummeted. The graph shows a spike at the start of the pandemic when share prices fell sharply compared to the amounts they had been planning so share out as dividends. For a short while – that thin spike it looked like the amount investors would get back was disproportionately high compared to their share price (which had dropped a lot). Sadly, that optimism faded quickly. The dividend yield falls towards 3.5% (from about 7%) after March 2020. Once the pandemic is under control companies will be able to start trading normally again and dividends will recover. The world’s stock markets will continue to grow for all of your lifetime, if we look after the planet.

A dividend yield is a just a percentage of return that an investment in something will pay. For example if you invest £1000 for a year in the FTSE 100 and the current dividend yield of the whole FTSE 100 index is 3%, you’ll get £30 back from all the companies to add to your investment. If the value of all the shares increases by the historical average of just over 5% too, you’ll get that too and hey presto, you’ve hit 8%, or an £80 return on your £1000 investment.

What is key, is reinvesting the dividends and letting these themselves accumulate more dividends in the future. Use your dividends to automatically buy more shares to help your pot grow over time. Reinvesting dividends is the key to money making money. Einstein called this the Eighth Wonder of the world. Please look up what the others are and tell me. Don’t tell your sisters! We need to see if they’ve read this far!

Currently 8% is by far the best return you will get from any investment you are likely to make in the next few years and far better than leaving money in any bank account. Putting your money in the markets isn’t wise if you think you’re likely to need that money in the next five years. It should grow but if you have to take it out just after the markets have dropped then you won’t get out as much as you could and you might even lose money.

Believe it or not investing in the stock market is even better than buying a house. This is a little controversial and I don’t want to dwell on the pros and cons. Just accept that this is as good a way as any to preparing for big expenses in the future and it’s pretty headache free.

I can tell you more about all of this at some point but for now, if you think you can afford to put some money away to accumulate over at least ten years, then you should be investing in the stock market. Then you’ll be on the road to getting rich and your money making money for you! You can start for as little as £20 per month.

A return rate of 8% is, I believe, a realistic figure to expect over a decade or more – and these are not investments that you should consider are short term. They’re for your future, when you’re paying for your children’s education, paying off your mortgage or planning to retire.

This graph tracks the growth rate of the biggest companies in America and I’m just showing you these to show you stock markets, on average, year after year go up.

Stock markets do have periods when they go down, and there have been, some monumental downs.

The first one was the called the Great Depression in the 1930 and it took 25 years for the markets to recover to the levels they were at before that ‘crash’. In the early 1970s another crash wiped out 72% of the top UK 30 companies. In the US it wasn’t so bad, they only saw the value of shares fall by about 45%. Nonetheless in a few years the market was tracking up again. A further crash happened in 2002 and all the gains made after that, were wiped out by the banking crisis in 2008. Even the enormous impact of that on the world was short-lived in the markets as they continued growing until the COVID-19 pandemic. Markets crashed in March 2020 and despite all the doom and gloom that continues as we head into 2021, the markets are again recovering, more so around the world than in the UK where the markets are factoring in the double whammy of the pandemic and Brexit. Despite both there is no doubt the markets will go up in time.

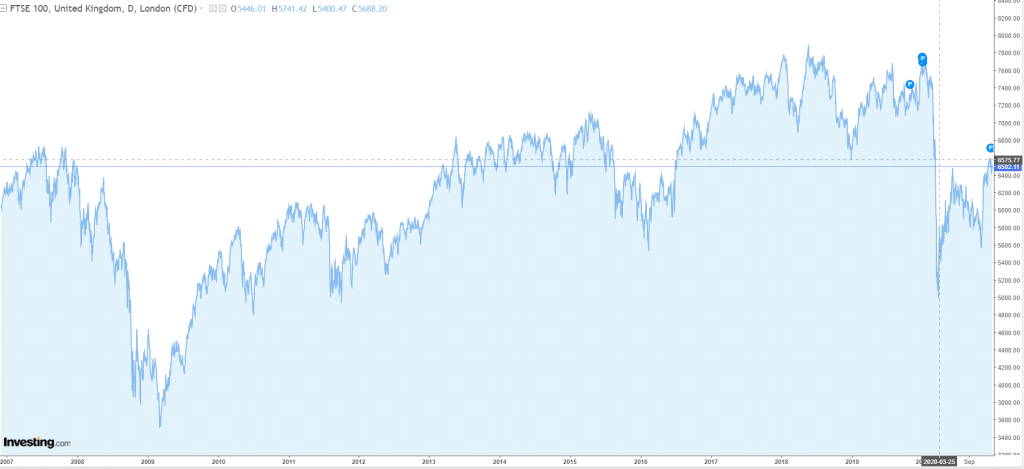

Here’s two graphs, one of the UK market, the FTSE from 1962 to 2011, and then from 2007 to present. The comments in the first one show what was happening in the world that provoked some of the ups and downs. The second one looks different because it only goes down to about 3400 – so the spikes you can see are just the top of the chart not the whole chart which the top one is of.

The reality of different world markets reacting differently to different circumstances means it’s not wise to put all your eggs in one basket and investing in different ‘markets’ is sensible and easy.

Nowadays we can invest in geographical regions, e.g. UK, USA, Europe and Asia, or we can invest in so called ‘emerging markets’ – countries that are rapidly developing like India and Brazil, or we can invest in industries, such as technology, pharmaceuticals and healthcare, agriculture, mining, retail, leisure and so on.

It’s really easy to spread your investments so that if one market goes down and another one goes up you get the safety of spreading the risk. One huge market is called the Bond market – this is where governments (or companies) pay a return for lending them money. The rates of return aren’t so high as other markets can be but government bonds are reliable. Western government bonds are very safe as western governments are very unlikely to become bankrupt and not be able to pay you interest on whatever you lend them, and when you want it, give you your money back. Western governments are also in need of vast amounts of cash to help fund the debt their countries took on during the banking crisis in 2008 and the COVID-19 pandemic.

It’s really hard to get the power of compound interest over to youngsters. Saving money for the future is just too boring. It represents something that youngsters can’t readily visualise – their financial situation many years ahead. Yet ironically, I think that it is something many parents, uncles and aunts lament themselves not knowing about earlier.

As we hit our 50s and 60s many of us should be in more comfortable positions than we were in our teens or decades three and four. These are times when we are impoverished – just battling to pay rent, save a deposit for a mortgage, run a car and go on holiday. Add having children to that and costs soar. At this point having income that is disposable enough to want to save it, rather than have a beer, a coffee or bar of chocolate is…unlikely.

Yet, if only we didn’t spend so much of our disposable income on those short term comforts – particularly those that mean we just consume unnecessary calories, then we could in later years be way better off than we’d have ever imagined.

Another factor in this discussion that makes youngsters eyes glaze over is that in order to make good returns you have to invest in the ‘markets’. Most youngsters barely understand what this means let alone be bold enough to deposit any of their spare cash there.

In truth, it really isn’t difficult and I think its beholden on those of us that do understand how to do it safely to get that message out. This is my attempt. It is aimed at you while you are still young enough to get the massive benefit of compound interest if you act soon.

So, let me know how much you think you can match – and remember it’s over a whole year – you don’t need to find all that money now, or whether you want to play at all.

Answer the question I set in the middle of the blog and come back to me before the end of January 2021.

Sent to my nieces in December 2020